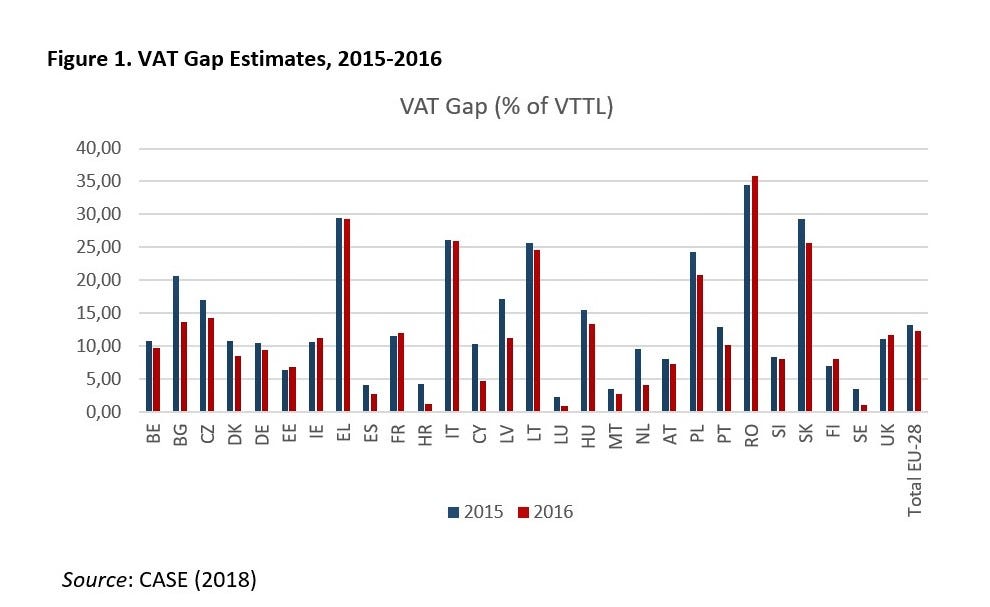

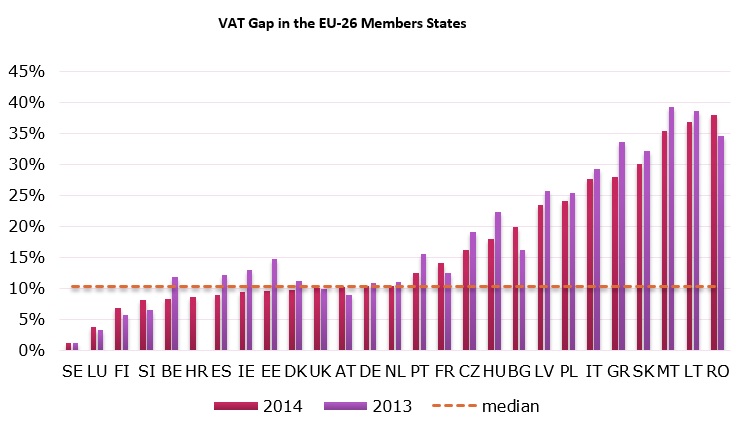

Non-compliance costs Europe €168 billion in VAT revenues in 2013 - CASE - Center for Social and Economic Research

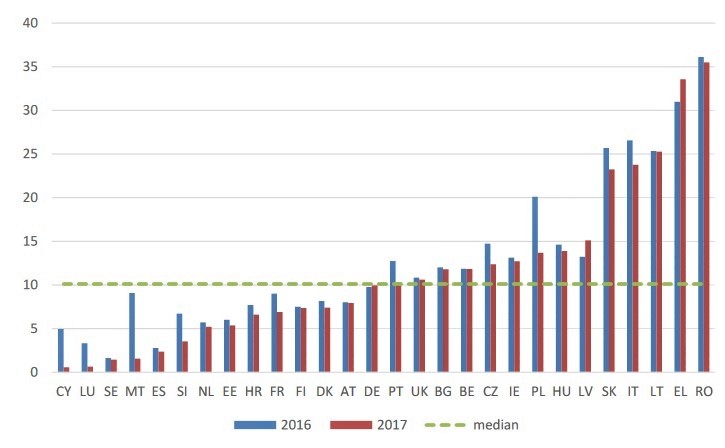

VAT non-compliance costs in Europe fell to €160 billion - CASE - Center for Social and Economic Research

Malta sees EU's highest VAT gap decrease; compliance and enforcement fourth-best - The Malta Independent

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

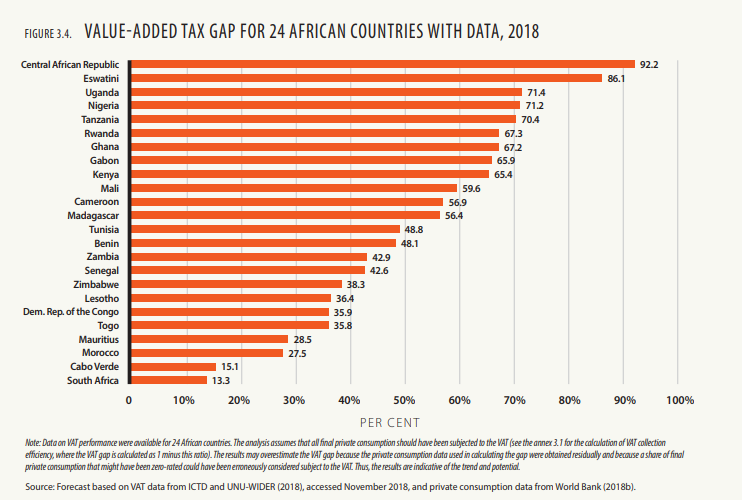

The Revenue Administration-Gap Analysis Program : The Revenue Administration-Gap Analysis Program : Model and Methodology for Value-Added Tax Gap Estimation:

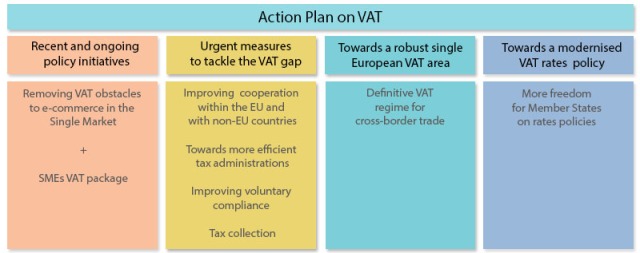

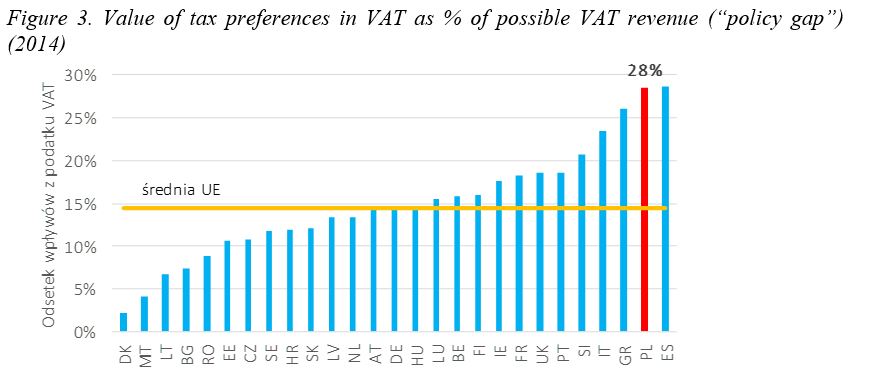

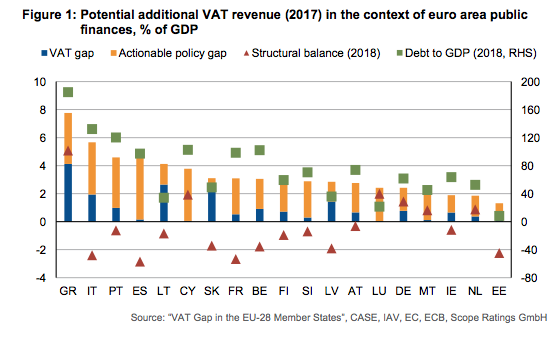

Mind the VAT gap: more effective consumption-tax collection could improve Eurozone's public finances